Solana became one of the most hyped cryptocurrencies of the 2021-22 market cycle. That’s probably because it took users on an emotional roller coaster, spiking by 50,000 percent from its launch before declining — over just seven months — by roughly 90 percent. Will it be able to rise from the ashes? Based on the small number of tokens set to enter supply in the years ahead, it seems fairly likely.

Historical Overview

Solana debuted in April 2020 as a Layer 1 protocol, launching at a price slightly below $1 before sinking to the 50-cent range. It peaked in November 2021 at more than $250. As of July 2022, it was flirting with a range between $20 to $40. The network began with 19.4 million tokens in circulation. The figure had increased by 326.1 million — or 1,680 percent — as of July 2022.

San Francisco-based Solana Labs, headed by CEO Anatoly Yakovenko, oversees the protocol’s development. It was enormously popular throughout the market’s 2021 bull run, and as of July, had attracted more than 350 projects — the largest of which was Gameta, which had more than 40,000 average daily users in July. That popularity made it the 9th largest crypto by market capitalization as of July 17, at $13.4 billion.

At the same time, that popularity has been a double-edged sword: Solana fans have become accustomed to frequent network outages produced by its inability to accommodate an overwhelming number of users.

Solana Does Not Have a Hard Cap

First things first: Solana does not have a capped supply, though you will find plenty of websites that incorrectly suggest it does. (CoinGecko, for instance, pegs total supply at 508 million.) However, its inflation rate is scheduled to decline to 1.5 percent annually around the 500 million mark, which some analysts conflate with a cap on supply. It is feasible the network will burn more in transaction fees in some years than the network produces via inflation, though that is not a guarantee.

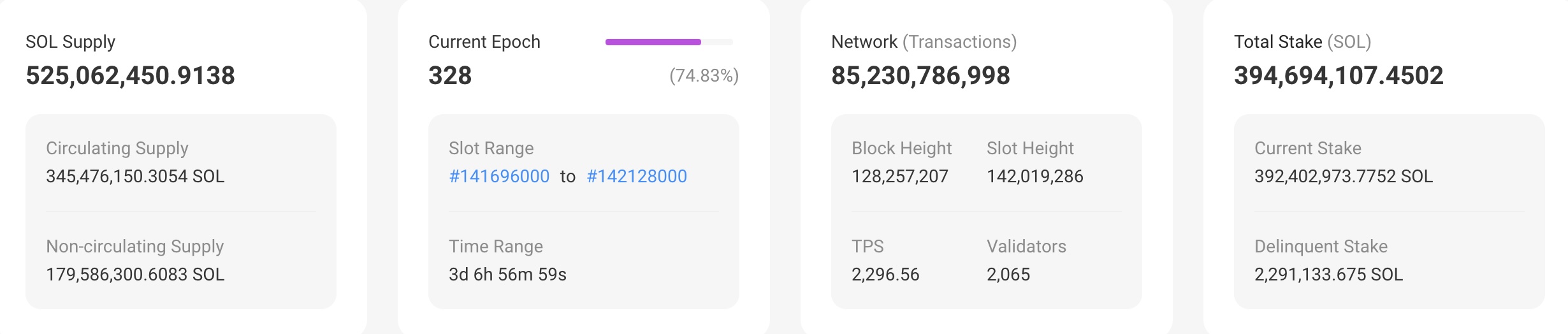

July 2022 Solana Circulation: 345.5 Million

As of July 17, there were 345.5 million Solana tokens in circulation. With the token’s inflation rate as of July standing at 7 percent — paid on a supply of 394.7 million staked tokens — an additional 27.62 million SOL are set to enter circulation in the year ahead. Compared to some of its competitors among Layer 1 protocols, the figure is fairly small. (Avalanche (AVAX), by contrast, should see circulation rise by 34 percent in the upcoming year.)

Inflation declines at a rate of 15 percent annually until it stabilizes at 1.5 percent. That should produce the following growth rates in the years ahead:

2022-23: 27.62 million tokens added (+7%) for a total of 422.32 million in July 2023;

2023-24: 21.11 million tokens added (+5.05%) for a total of 443.43 million in July 2024;

2024-25: 19.02 million tokens added (+4.29%) for a total of 462.45 million in July 2025;

2025-26: 16.83 million tokens added (+3.64) for a total of 479.31 million July 2026;

2026-27: 14.82 million tokens added (+3.09%) for a total of 494.13 million in July 2027.

July 2027 Solana Circulation: 494.13 Million

Unlike other cryptocurrencies, Solana’s inflation shouldn’t pose a significant obstacle in returning to its all-time price high. When Solana’s per-token price hit $259 in November — based on CoinGecko data — it held a $77.4 market cap. As of July 17, at a price of $39.71, its corresponding market cap stood at $13.7 billion.

In order to return to $259 in July 2027, with a circulating supply of 494.13 million, Solana’s market cap would need to reach $127.97 billion. That would be a paltry 65.33 percent increase compared to November 2021 — barely more than the daily inflation rate for U.S. fiat.

RELATED: Safemoon’s ‘Reflection’ Tokenomics — Legitimate or a ‘Slow Rug Pull’?

Why is the Number of Staked Solana Higher than Circulating Supply?

You may have noticed that Solana’s reported number of staked tokens exceeds the number in circulation. The reason is that the Solana Foundation does not include tokens that it has staked in its definition of “circulating supply.” At Solana’s inception, 95 million tokens were allocated to the foundation. As of July 2022, it wasn’t entirely clear how many the foundation had retained. Foundation representatives have been cagey about the issue, and they did not immediately respond to a request for comment from GoblinCrypto. The foundation claimed in May 2020 that it burned 11.3 million tokens, but a subsequent audit found that it only burned 8 million, while dumping the other 3.3 million on the market.

A Known Unknown

As we noted, as of July 2022, the Solana Foundation held somewhere around 80 million tokens. Another 30 million were allocated to the network’s founders at its birth. While those numbers are included in its circulating supply, it isn’t clear how many of those 110+ million tokens — which are worth more than 20 percent of Solana’s supply — will be unleashed on an unsuspecting market in the future.

Why Do I See Different Numbers on Different Websites?

It is common to see statistical aggregators — especially those that try to track data in real-time — publish numbers for Solana and other tokens that are not quite accurate. (That applies especially to CoinGecko, CoinMarketCap, and sometimes Messari).

Alluding to this reality in an August 2020 report, Solana developers noted, “Due to distributions of airdrops and validator fees, as well as transaction fee burning, the circulating supply as shown on CoinGecko, CoinMarketCap, other price references sites, and the Solana Explorer may differ slightly from the numbers reported here. The circulating supply as shown on CoinMarketCap is incorrect, and Solana team members are working with them to resolve this.”

Numbers related to crypto circulation quickly become stale with the passage of time. Generally, you should try to rely on the most recent data available, and avoid automated trackers.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Solana

Solana  Dogecoin

Dogecoin  Cardano

Cardano  Chainlink

Chainlink  Avalanche

Avalanche  Polkadot

Polkadot  Monero

Monero  Cronos

Cronos  Aave

Aave  Algorand

Algorand  Tezos

Tezos  Axie Infinity

Axie Infinity  Polygon

Polygon  Onyxcoin

Onyxcoin  Golem

Golem  Flux

Flux