Aug. 27, 2022 Update: Developers announced a plan on Aug. 25 to revamp the emissions schedule described below. You can read about their plan in full here: Rug Pull? DeFi Kingdom Developers Announce Plan to Seize Locked Liquidity Pool Payments

The locked stash of DeFi Kingdom’s (DFK) native token, Jewel, will begin unlocking in mid-September. Players have been fretting about whether that event will permanently drive the token’s price down. Publicly available facts about the situation are scarce, so Goblin Crypto crunched a few numbers to assess possible scenarios.

July 2022: 100 Million Jewel in Circulation

As of July 15, Jewel held a token price of 16.3 cents, down from a peak of roughly $22 in early January. The lower price reflected 100,628,942 tokens in circulation, according to DFK’s in-game tracker, up from roughly 61 million at its peak price.

Another 283,056,623 tokens were in lockdown, bringing total supply to 383 million. Locked tokens will begin unlocking in mid-September at a rate of roughly 1.9 percent weekly, putting supply on track to fully unlock in 72 weeks. Emissions from DFK’s liquidity pool will continue through that period, putting supply at its hard cap of 500 million in the second quarter of 2024.

December 2022: 190 Million Jewel in Circulation

More than 20 percent of the 283 million locked tokens will unlock between September and December 2022. As a raw number, that’s 64 million. Combined with emissions that immediately unlock, about 90 million tokens will enter circulation over the five months between July and year’s end, raising total circulation from 100 million to 190 million.

May 2024: ~480 Million Jewel in Circulation

An average of 20 million Jewel will enter circulation every month for the 16 months following December 2023. Emissions end on May 19, 2024.

If we deduct a handful of tokens with the assumption that they will be out of circulation — lost to dead or inactive players, lost wallets, burning, or because they’re sitting in developers’ funds — we come to the estimate that about 480 million Jewel will be circulating in May 2024. We cannot predict what Jewel’s market capitalization will be at that time, but we can take a couple of examples from different points in time to find what Jewel’s price will be if it holds past or present valuations.

At July’s Market Cap of $17 million: 3.5 cents

At January’s Market Cap of $1.3 billion: $2.70

RELATED: DeFi Kingdom Guides & Charts for Questing, Leveling, PVP, Pets, and More

July 2024: 560 Million if You Count Crystal

In March, the DFK team expanded their project beyond its original chain, Harmony, to launch another version of the game called “Crystalvale” on Avalanche (AVAX), along with another token, Crystal. As of July 15, Crystal circulation stood at 30,305,774, with another 38 million locked and a hard cap of 125 million. At a token price of 24 cents, circulating Crystal held a total market cap of $7.2. million, down from $12.3 million in June.

The supply of unlocked Crystal will probably be close to 40 million by the time Jewel begins unlocking in September. Locked Crystal will begin emitting on March 22, 2023. Like Jewel, it will continue unlocking at a rate of 1.9 percent weekly. That means a little more than 60 percent will unlock by the end of 2023, with a full unlock by November 2024. Unlocking will end with a total of 125 million Crystal in circulation. If we assume — as many expect — that the price of Crystal will eventually converge with the price of Jewel, we could run another analysis that combines Jewel and Crystal in terms of supply and market capitalization.

If we project Jewel’s circulation at 480 million and add that figure to 125 million circulating Crystal, we have a combined total of 605 million tokens. Adding their market caps and extrapolating, we come up with the following price projection. It applies to each token effective July 2024.

Jewel/Crystal Price at July 15, 2022’s Combined Market Cap of $24.2 Million: 4 cents

Jewel/Crystal Price at January’s Peak Market Cap of $1.3 Billion: $2.14

RELATED: Safemoon’s ‘Reflection’ Tokenomics — Legitimate or a ‘Slow Rug Pull’?

Developers May Add New Tokens on Other Chains

A final caveat to keep in mind is that future price action depends on a couple of additional factors. One is the obvious: The number of people interested in playing the game. The second, more subtle variable is whether the DFK team expands their project to additional chains. When the project expanded to AVAX, many users expected it to bring additional players. Instead, they saw the opposite effect. The number of players interacting with the game fell from 30,000 as of March 31, the day of the expansion, to about 10,800 as of June 3. That was a reduction of more than 60 percent. It meant a diminishing supply of money available to purchase an increasing supply of DFK tokens.

Of course, the problem has been partially related to bear-market conditions. Over the same period, the price of bitcoin fell from $47,000 to $29,600. Market capitalization for cryptocurrency more broadly fell from $2.2 trillion to $1.3 trillion, a 40 percent decline. So some decline in investment is understandable. But Jewel’s price decline over the same period — 95 percent — is abysmal by comparison.

Granted, the expansion to AVAX took place for reasons beyond hopes of expanding the game’s appeal. As the largest project on the Harmony, DFK was the most affected by constant technical difficulties and outages. Migrating to an alternative was an imperative more than an option.

However, the numbers are worth thinking about before future expansions. Again, the expansion to Crystalvale took place on March 31. That was well after players voiced their concerns about Jewel’s unlocking schedule. If developers expand the game to additional chains in the future, it is not clear that they will have any interest in adopting an alternative tokenomics model.

RELATED: Axie Infinity’s Data on Token Circulation is a Dumpster Fire

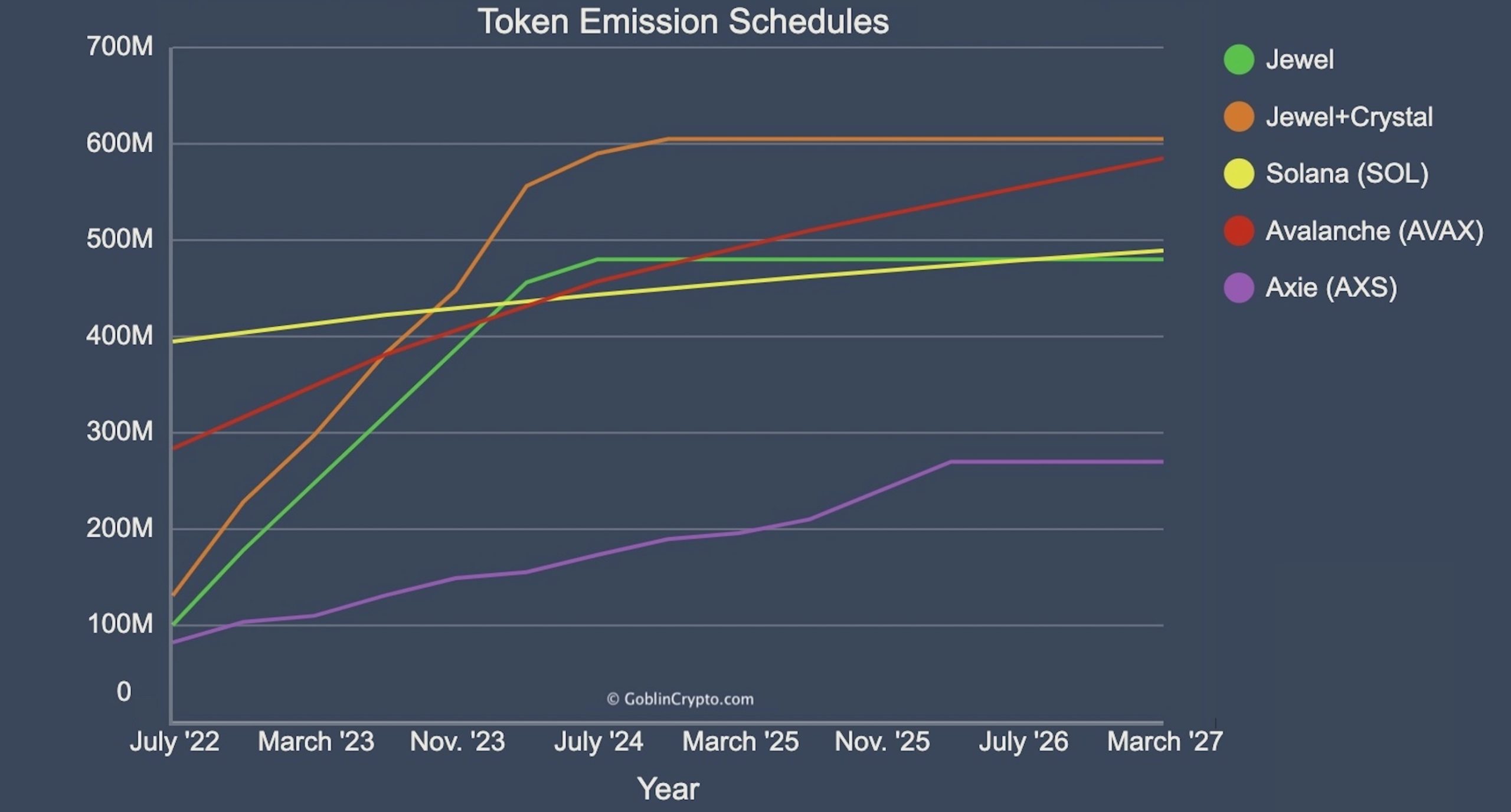

Line Graph Comparing Emission Rates

Here’s a graph depicting Jewel’s projected inflation rate. It also shows what the rate looks like if you combine it with Crystal. Compare it with two popular Layer 1 protocols, Avalanche and Solana, and Axie Infinity’s AXS. As you can see, DFK’s token expansion will take place much more rapidly than it will with any of those projects.

Editor’s Note: This article was originally published on June 3, 2022. It was updated with the latest numbers on July 17.

RELATED: Trouble in the (DeFi) Kingdom: Largest Guild Asks Game Mods to Stop ‘Stigmatizing’ Them

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Cardano

Cardano  Dogecoin

Dogecoin  Solana

Solana  Polkadot

Polkadot  Avalanche

Avalanche  Chainlink

Chainlink  Monero

Monero  Cronos

Cronos  Aave

Aave  Algorand

Algorand  Tezos

Tezos  Axie Infinity

Axie Infinity  Golem

Golem  Flux

Flux  Onyxcoin

Onyxcoin