Attorneys revealed in a 1,157-page legal filing published on Monday that an executive at disgraced crypto firm Three Arrows Capital provided an unconventional response to a creditor who requested repayment before the firm went bankrupt.

The exchange occurred on May 11, when Blockchain.com’s Scott Odell messaged 3AC’s chief operating officer, Edward Zhao. Attorneys said he messaged Zhao after he “earned more about 3AC’s Luna exposure.” The crypto plummeted by 99 percent the following day after the stablecoin created by its developer, Terra USD (UST), lost its $1 peg.

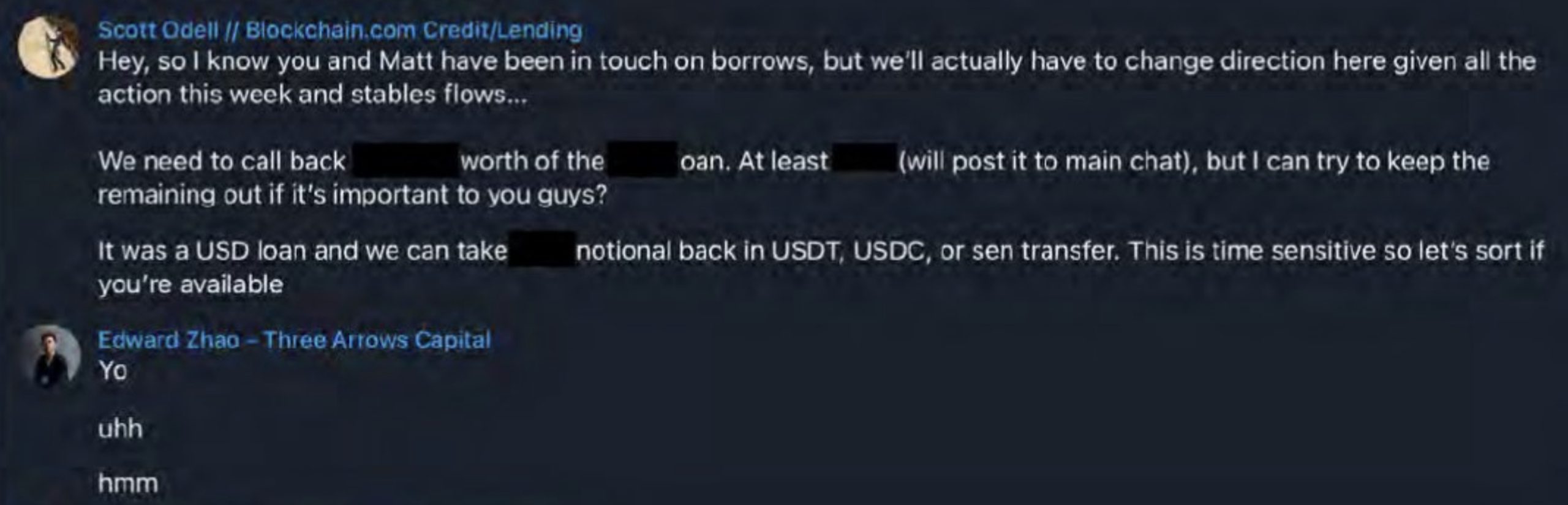

“I know you and [another executive] have been in touch on borrows, but we’ll actually have to change direction here given all the action this week and stables flows,” a screenshot of the exchange showed Odell telling Zhao. He added that Blockchain.com needed “to call back” a portion of its loan to 3AC, though the exact amount was redacted. “But I can try to keep the remaining out of it’s important to you guys,” he said.

RELATED: Liquidators Accuse 3AC of Using Borrowed Funds to Buy a $50 Million Yacht

“It was a USD loan and we can take [redacted] notional back in USDT, USDC, or [a] transfer,” Odell added. “This is time sensitive so let’s sort it out if you’re available.”

“Yo,” the screenshot showed Zhao responding. He added in two follow-up messages, “Uhh, hmm.”

The exchange was included in an application that liquidators submitted to the High Court of Singapore. They asked the court to grant a stay on claims against 3AC, in addition to requesting access to the company’s offices in Singapore. The filing revealed, among other things, that the company owes $3.5 billion to 27 creditors. Top creditors include the Digital Currency Group ($1.2 billion), distressed crypto exchange Voyager Digital ($674 million), and crypto exchange Deribit $(80 million). Other creditors include co-founder Zhu Su, who is asking his own company for repayment on a $5 million loan, as well as Kelly Kaili Chen, the wife of co-founder Kyle Davies, who has filed a claim for $65.7 million.

Blockchain.com and Deribit were among the first creditors to take legal action against 3AC after its financial distress began in June, which resulted in a British Virgin Islands court ordering it into bankruptcy on June 24. The company filed for bankruptcy in New York on July 1 in an effort to control the liquidation of its assets. It’s separately embroiled in a dispute with the Monetary Authority of Singapore, which said last month that 3AC had provided “false information” during an effort to move its corporate headquarters from that country to the Virgin Islands.

You can read the full 1,157-page filing out of Singapore — dated July 9 but first made public on Monday — embedded above.

RELATED: Morgan Creek Digital Reveals BlockFi Worth Less than its $1 Billion to Loan to 3AC

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Cardano

Cardano  Dogecoin

Dogecoin  Solana

Solana  Polkadot

Polkadot  Avalanche

Avalanche  Chainlink

Chainlink  Monero

Monero  Cronos

Cronos  Aave

Aave  Algorand

Algorand  Tezos

Tezos  Axie Infinity

Axie Infinity  Golem

Golem  Flux

Flux  Onyxcoin

Onyxcoin