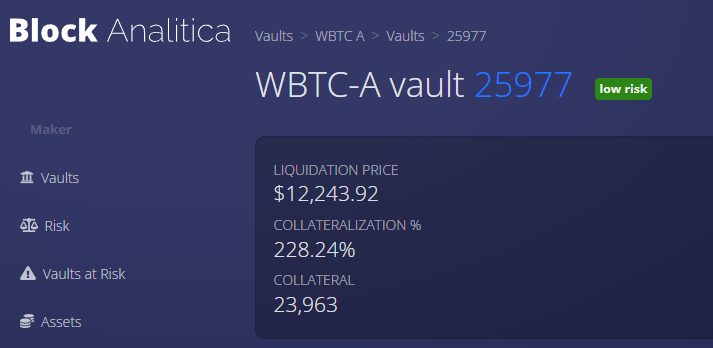

Celsius Network stands to see its $463 million Maker Dao loan liquidated if bitcoin hits a price of $12,243 after making several large repayments, according to blockchain data.

The company furnished $142 million in repayments on loans on Maker Dao and Compound, according to the data. It repaid an additional $67 million on the Aave Protocol on July 2, lowering its liquidation price on a staked Ethereum (stETH) wallet to an Ethereum price of $497.

Celsius froze customer assets on June 13, calling it “necessary” for “our entire community.” The company hired multiple accounting and legal firms in subsequent weeks to assist in determining whether it should restructure or declare bankruptcy.

RELATED: RELATED: Celsius Hires Citigroup; Seeks to Survive a Margin Call When Bitcoin Hits $15,100

It was not immediately clear how the company obtained the funds to make repayments. “Most assuming at this point that Celsius’ equity is worth effectively $0,” one prominent blockchain analyst noted on Twitter. “So I’m surprised they’re paying this down (and have funds to do so).”

Celsius’ liquidation price stood around $22,000 on the day it froze customer assets. The company managed to lower that number to nearly $15,000 days before bitcoin dropped to $17,600 on June 17. As of Sunday, bitcoin stood a little above $19,000, while ETH sat slightly below than $1,100. Celsius’ Maker Dao collateral as of Sunday included 23,963 bitcoin.

The company used “rehypothecation” — the re-investment of its users’ money — to seek high-interest returns. It began struggling when Terraform Labs’ products — Terra USD (USDT) and LUNA — collapsed in May. Blockchain analytics Nansen said in a report published Wednesday that Celsius began panic-selling assets nearly a week before freezing customer accounts.

RELATED: Celsius Denies Report that CEO Alex Mashinsky Attempted to Flee US for Israel

Celsius sought to reassure customers in a Wednesday blog post. “We continue to take important steps to preserve and protect assets and explore options available to us,” the company said. “These options include pursuing strategic transactions as well as a restructuring of our liabilities, among other avenues. These exhaustive explorations are complex and take time, but we want the community to know that our teams are working with experts from many different disciplines.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  XRP

XRP  Cardano

Cardano  Dogecoin

Dogecoin  Solana

Solana  Polkadot

Polkadot  Avalanche

Avalanche  Chainlink

Chainlink  Monero

Monero  Cronos

Cronos  Aave

Aave  Algorand

Algorand  Tezos

Tezos  Axie Infinity

Axie Infinity  Golem

Golem  Flux

Flux  Onyxcoin

Onyxcoin